NEWS

News Center

Analysis of China's polystyrene production, capacity, operating rate, import and export, and price trend in 2021

Publish Time:

2022-07-19 08:47

Source:

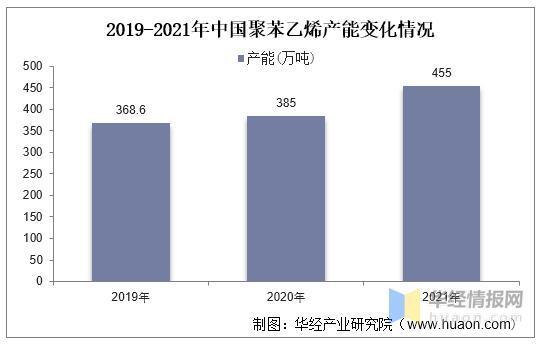

China's polystyrene production capacity has continued to grow. Data shows that in 2019-2021, China's polystyrene production capacity was 3.686 million tons, 3.85 million tons, and 4.55 million tons, respectively.

Changes in China's Polystyrene Production Capacity from 2019-2021

Data Source: Compiled from Public Information

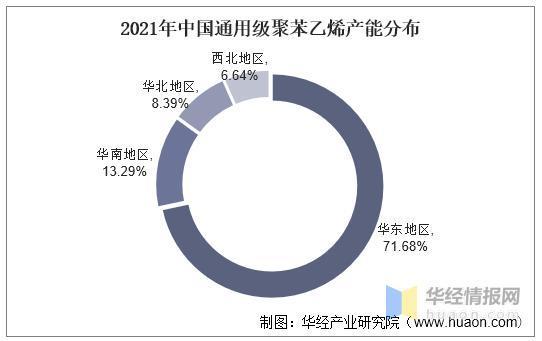

In 2021, China's general-purpose polystyrene production capacity was 2.86 million tons. Of this, the East China region accounted for 2.05 million tons, or 71.68% of the total industry capacity. The South China region was second, with a 13.29% share. Production capacity in North China and Northwest China was relatively small, accounting for 8.39% and 6.64%, respectively.

Distribution of China's General-Purpose Polystyrene Production Capacity in 2021

Data Source: Compiled from Public Information

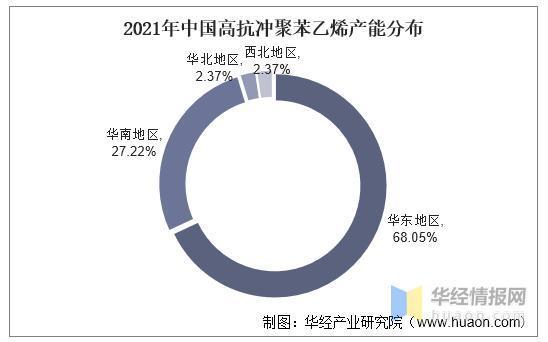

In 2021, China's high-impact polystyrene production capacity was 1.69 million tons. The East China region again ranked first, accounting for 68.05% of production capacity. The South China region had approximately 460,000 tons, accounting for 27.22%.

Distribution of China's High-Impact Polystyrene Production Capacity in 2021

Data Source: Compiled from Public Information

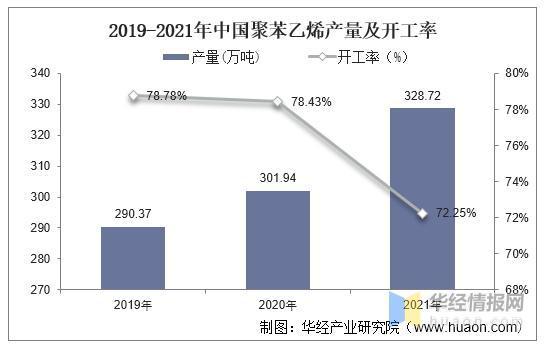

In terms of industry output and operating rate, from 2019 to 2021, the overall operating load of the polystyrene industry was 78.78%, 78.43%, and 72.25%, respectively. The corresponding output during this period was 2.9037 million tons, 3.0194 million tons, and 3.2872 million tons, respectively. The industry's operating rate remained high, and output showed an upward trend, mainly due to an increase in overall downstream demand compared to the previous period. The entire polystyrene market has begun to gradually transition to a state of tight supply and demand balance.

China's Polystyrene Output and Operating Rate from 2019-2021

Data Source: Compiled from Public Information

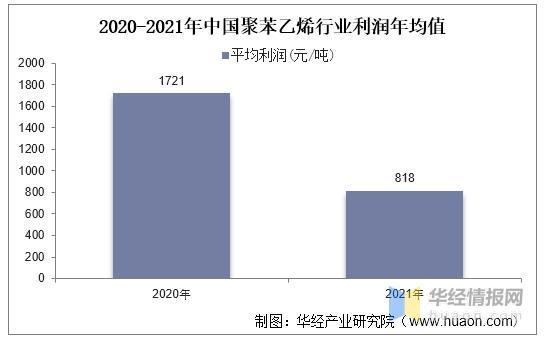

In 2020, the average annual profit of the polystyrene industry reached 1721 yuan/ton. In 2021, due to multiple coincidental factors in the styrene market, coupled with the sudden rise in prices of bulk non-ferrous raw materials such as copper and aluminum in the downstream market, as well as the impact of logistics costs, cost control in the entire PS downstream market was strengthened. These two factors together led to a narrowing of the average annual profit level of the polystyrene industry to 818 yuan/ton.

Average Annual Profit of China's Polystyrene Industry in 2020-2021

Data Source: Compiled from Public Information

The market selling price of polystyrene is highly correlated with the price of its main raw material, styrene, and is also affected by the supply and demand situation of polystyrene. In 2021, the price of polystyrene in China fluctuated relatively steadily, exceeding 10,000 yuan/ton in all months except January and March.

Price Trend Chart of Polystyrene in China from January to December 2021

Data Source: Compiled from Public Information

In terms of import and export volume, China's polystyrene is mainly exported, with imports playing a secondary role. In 2021, China exported 1.199 million tons of polystyrene, a year-on-year decrease of 11.84%, and imported 223,000 tons, a year-on-year increase of 5.2%.

China's Polystyrene Import and Export Volume from 2016-2021

Data Source: China Customs, Huajing Industry Research Institute

Original Title: Status Quo and Development Trend of China's Polystyrene (PS) Industry in 2021: Specialization Will Become Increasingly Important

Huajing Industry Research Institute has conducted an in-depth analysis of the development status, upstream and downstream industrial chains, competitive landscape, and key enterprises of China's polystyrene (PS) industry, minimizing investment risks and operating costs for enterprises and improving their competitiveness. Using various data analysis techniques, the institute predicts industry development trends to help enterprises seize market opportunities. For more detailed information, please refer to the "2022-2027 China Polystyrene Industry Market In-depth Analysis and Investment Strategy Planning Report" published by Huajing Industry Research Institute.

Previous Page

Previous Page